The recent surprise drop in crude oil prices are having big impacts on international LNG prices and may cause a slowdown in the development of LNG export terminals globally. LNG is liquefied natural gas, cooled to a temperature of -260° F, for the purpose of compression and transportation. International shipments of LNG by container ship are generally price indexed to crude oil meaning that falling oil prices have led to a comparable drop in LNG prices.

Demand for LNG in Asia has been soft due to mild weather this winter, contributing to the slide in prices. 75% of global LNG demand is in Asia with the bulk of the cargos going to Japan, followed by South Korea and then China, India and Taiwan.

Demand for LNG in Asia has been soft due to mild weather this winter, contributing to the slide in prices. 75% of global LNG demand is in Asia with the bulk of the cargos going to Japan, followed by South Korea and then China, India and Taiwan.

In South Korea, imports were down nine per cent year-on-year. Slowing gas demand growth has also led to concerns that China will struggle to absorb contracted LNG, which will double over the next three years.

Supply of LNG in the Pacific basin has grown substantially in recent years, leading to an oversupplied market.

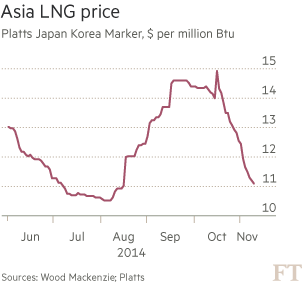

Prices for LNG in Japan hit $10.069 per MMBtu on December 15, having fallen from around $16 at the start of 2014. As LNG contract prices are typically based on the average of the preceding six to nine months, it will be mid-2015 before suppliers feel the full effects of the low oil price on their cash flow.

The LNG price decline came in two stages. Prices dropped in the summer, as new supply from Papua New Guinea (PNG LNG) hit the market. Prices then fell further as Brent oil dropped from $110/bbl in August, to below $60/bbl in December.

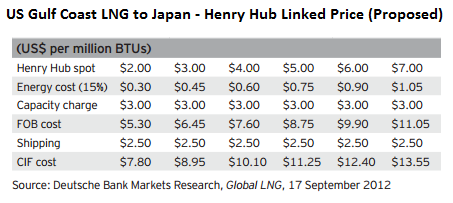

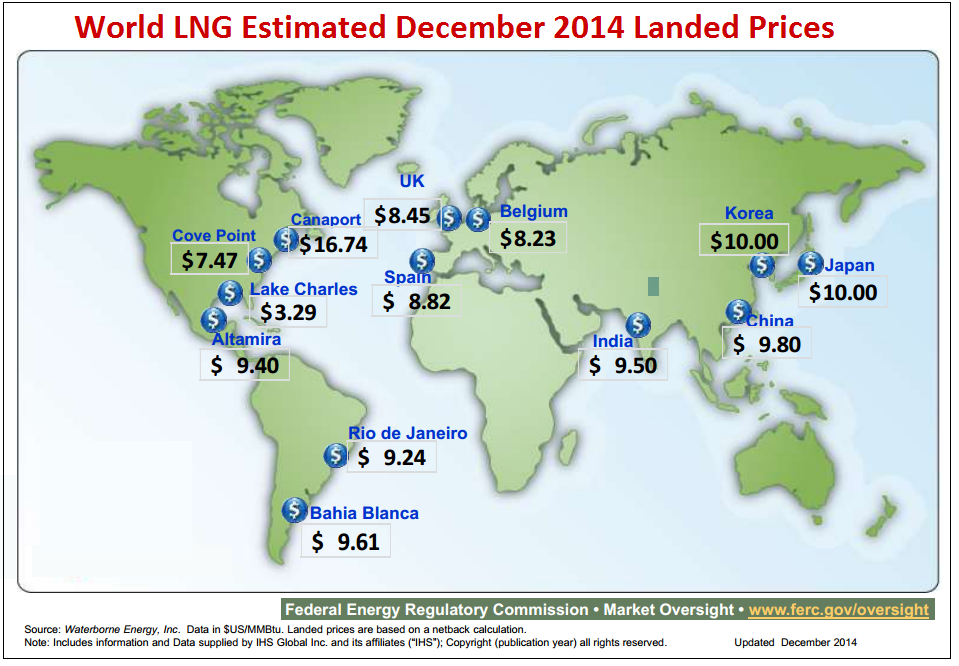

When Brent crude sells for $100, oil-linked natural gas contracts typically translate to around $14 per million Btu (MMBtu), giving U.S. LNG a big price advantage. This advantage disappears as crude prices fall, with crude at $60 LNG indexes to $8.40 per MMBtu. U.S. LNG producers have been targeting prices of $11 or $12 per MMBtu to be profitable after absorbing the costs of buying the gas, liquefying it, shipping it around the globe and regasifying it.

When crude oil prices dropped below $80 per barrel, LNG from the USA became less competitive in Asia compared to plentiful gas from Australia and Qatar. Falling oil prices have the effect of increasing competition from oil. Price action in Asia may lead to more gas being diverted to Europe and South America, where U.S. gas may find a niche. Such a shift also could reshape European gas markets by lowering prices and squeezing out some Russian pipeline gas.

When crude oil prices dropped below $80 per barrel, LNG from the USA became less competitive in Asia compared to plentiful gas from Australia and Qatar. Falling oil prices have the effect of increasing competition from oil. Price action in Asia may lead to more gas being diverted to Europe and South America, where U.S. gas may find a niche. Such a shift also could reshape European gas markets by lowering prices and squeezing out some Russian pipeline gas.

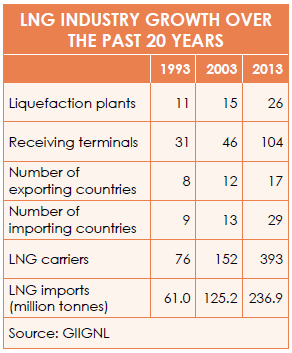

Many countries have entered the LNG export trade in the last decade, contributing to a crowded market. Egypt began shipping LNG in 2005, Equatorial Guinea and Norway in 207, Russia and Yemen in 2009, Peru in 2010, Angola in 2013 and Papua New Guinea in 2014. Australia has also greatly increased its export capacity and expects to overtake Qatar as the world export leader. Major project proposals are also in the works in Russia, Canada and East Africa, all of which contribute to a well-supplied international market.

Many countries have entered the LNG export trade in the last decade, contributing to a crowded market. Egypt began shipping LNG in 2005, Equatorial Guinea and Norway in 207, Russia and Yemen in 2009, Peru in 2010, Angola in 2013 and Papua New Guinea in 2014. Australia has also greatly increased its export capacity and expects to overtake Qatar as the world export leader. Major project proposals are also in the works in Russia, Canada and East Africa, all of which contribute to a well-supplied international market.

The USA today has issued permits for four LNG export terminals, in addition to the existing Kenai terminal in Alaska. A dozen or more applications are in process at FERC, but only a few more are expected to be given permits. Projects that have not received FIDs (Final Investment Decisions) have uncertain futures, both in the US and globally. A number of proposed projects in Australia have been shelved and greenfield projects in Canada have been challenged as well due to high costs.

With projects under construction going ahead as companies treat them as sunk cost, Australia’s LNG export capacity is set to more than triple to 86 million tonnes a year before 2020, putting it ahead of current leader Qatar which exports 77 million tonnes annually and U.S. expectations of selling 61.5 million tonnes per year by 2020.

Even though the U.S. has only ever had minimal LNG exports, US LNG suppliers have been seen as attractive to Asian buyers due to the perception of the U.S. offering very secure supply, with firm contract commitments.

Adding to the interest in U.S. supplies have been efforts in recent years to index U.S. LNG to Henry Hub prices rather than crude oil prices. Asian buyers were seeking to break away from expensive oil linked contracts and take advantage of inexpensive U.S. gas prices, but now with crude oil prices in a freefall, buyers are backing away from changing the formula for now.

LNG suppliers will be hoping for a cold 2015, but the background of a low oil price environment will place pressure on LNG prices in the near term, however long-term growth prospects remain compelling.