The Governor of Wyoming, Matt Mead, is all in for natural gas. The Governor commissioned a report titled the Wyoming LNG Roadmap. The report finds that Wyoming is well positioned to lead the USA in the development of a robust, sustainable LNG industry for High Horsepower (HHP) applications.

The report is a comprehensive analysis of the feasibility, potential, costs and benefits of using liquefied natural gas to replace or supplement diesel fuel in Wyoming’s HHP sectors. The roadmap will be used to help guide the state in its development of energy policies and educational programs, as well as identify ideal opportunities for investment in infrastructure and technology to help spur natural gas market development.

Natural gas can help spur job growth while improving air quality and at the same time save money by displacing more expensive diesel fuel that is used in large quantities by high horsepower applications in Wyoming such as mine trucks, locomotives, energy exploration and production engines, and over-the-road trucking.

Wyoming has vast natural resources and is one of the world’s most prolific energy-producing regions. Wyoming ranks number one among US states in coal production and produces about 40% of all the coal mined in the USA. Nine of the country’s top ten coal mines are located in Wyoming’s Powder River Basin (PRB). Wyoming ranks third among states in natural gas production, producing 9% of American natural gas, and has an estimated 35 trillion cubic feet of reserves. WY also ranks eighth among states in oil production. These vast resources and activities translate to heavy use of HHP equipment and diesel fuel.

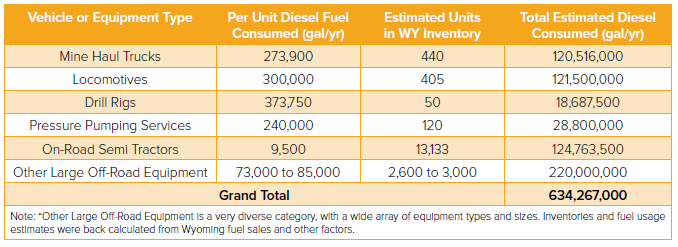

The collective market for mine haul trucks, locomotives, drill rigs, pressure pumping services, on-road semi-tractors and other large off-road equipment is about 634 million gallons of diesel/year. There are about 16,000 diesel-powered units collectively in the six sectors using tens of thousands of gallons of fuel annually.

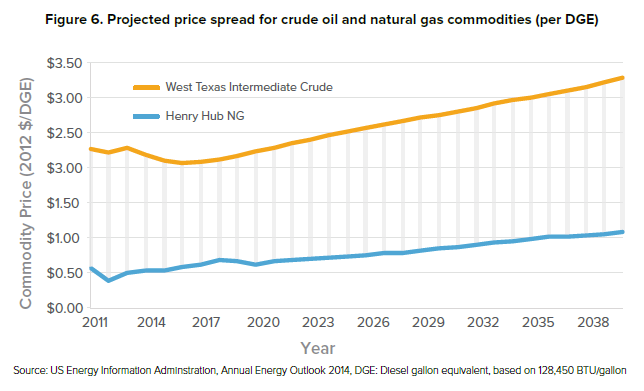

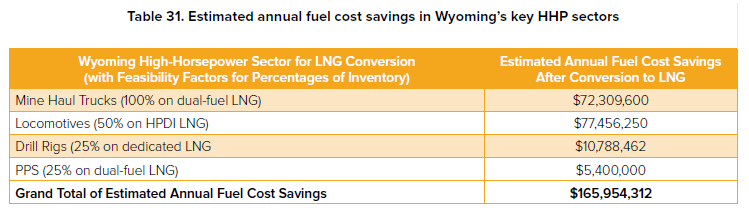

The primary driver for a transition to natural gas as a replacement for diesel fuel is economics, LNG is 40% cheaper than diesel on an energy equivalent basis. Secondly, reducing emissions from diesel of criteria pollutants and greenhouse gasses is also very important. Finally, the ability to leverage a “home-grown” fuel in will both improve Wyoming’s employment and economy and improve energy diversity.

For a conversion to natural gas to achieve attractive economics two key parameters must be met. First there must be high annual fuel use and secondly there needs to be a large price differential between LNG and diesel. In Wyoming’s very large HHP sectors, both of these factors point to very favorable economics for conversion to LNG.

Baseline diesel use as compiled in the report is as follows:

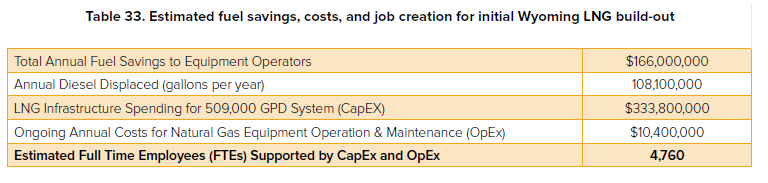

According the assumptions built into the report, the potential “upper bound” demand for LNG in Wyoming over the coming decade is estimated to be approximately 186 million LNG gallons per year (GPY). This is equivalent to 509,000 gallons per day (GPD) of LNG production, or approximately 38.7 million cubic feet per day (MMcf/D).

This upper bound estimate for LNG demand in Wyoming’s HHP sectors refers to a time frame of 10 to 20 years to reach full fruition. For this LNG demand to be fully realized, LNG-ready HHP vehicles and equipment will need to be deployed in careful orchestration with Wyoming’s build-out of the supporting fuel production, distribution and dispensing facilities.

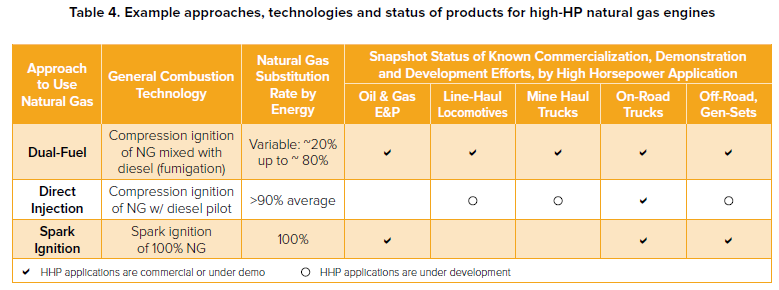

Each of the industries surveyed is going through their own research and development processes to commercialize LNG equipment suitable for their needs. None of the industries have mature technology packages available today for using natural gas, but in all cases key technical hurdles have been overcome and pilot projects have been successfully completed. There are three categories of natural gas engines, Dual-Fuel combines gas with diesel in varying quantities in retrofitted diesel compression engines. High Pressure-Direct Injection uses a small amount of diesel and mostly natural gas, it was developed by Westport and has been adopted by Caterpillar for their mining trucks and is also used in over-the-road trucking and can be retrofitted or built into new engines. Spark ignition engines are mostly new build engines and works well in medium sized engines but lacks horsepower for the most demanding applications.

An estimated $327 to $400 million in capital investments will be required to build out Wyoming’s infrastructure to be capable of producing, distributing, storing and dispensing 509,000 GPD of locally sourced LNG. This level of investment in state-of-the-art gas processing facilities, LNG production plants and supply chain infrastructure will bring compelling economic benefits to Wyoming that are expected to include direct infusions of capital into the Wyoming economy and the creation of well-paying technology-based jobs in construction and operations.

There will be new opportunities for Wyoming to develop educational programs and curriculum focused on clean energy technology in general, and the HHP LNG sector in particular. This will provide major new opportunities for cutting-edge education, technical training, skill development, and high-income employment for Wyoming’s residents.

New LNG sources will need to be developed in close proximity to centers of concentrated fuel demand which will be around the Powder River Basin (Campbell and Converse Counties) and in the Southwest part of the state. The authors of the report find that it would be best not to build one large centralized LNG plant due to high capital costs for developers who would face risks over the ten to twenty year phase in of the LNG market. Secondly, there would be higher costs for consumers of LNG if it is transported over 250 miles.

The optimal approach would be to develop multiple localized mid and small scale LNG production facilities (100,000 to 250,000 GPD). These centralized plants could be supplemented by numerous micro-scale LNG production plants (5,000 to 10,000 GPD) in more remote locations where smaller volumes are needed, such as at a mine facility where they fuel their local fleet of trucks.

“This report shows there is potential for expansion of LNG use in Wyoming that can add value to our natural gas, be a sound business decision for Wyoming industries and lead to job growth,” Governor Mead said. “I felt this was an opportune time to team up with private companies to facilitate research and understand what possibilities exist. The private sector will ultimately make investments in LNG technologies based on market conditions, and this report can be a catalyst.”

The Wyoming LNG Roadmap report was written by Gladstein, Neandross & Associates, North America’s leading clean transportation and energy consulting firm, who were joined by a coalition of private-sector businesses: Ambre Energy, Anadarko Petroleum, Caterpillar, Chart Industries, Desser-Rand, Eagle LNG Partners, Encana, Ensign, GE Oil & Gas, ONEOK Partners, TallGrass Energy, Westport, and Wyoming Machinery.

Published at FC Gas Intelligence, Nov. 13, 2014