There have been a variety of efforts in recent years to harmonize energy policy and markets across USA, Canada, and Mexico. At the North American Gas Forum meeting this past week in Washington D.C. some of these efforts were discussed.

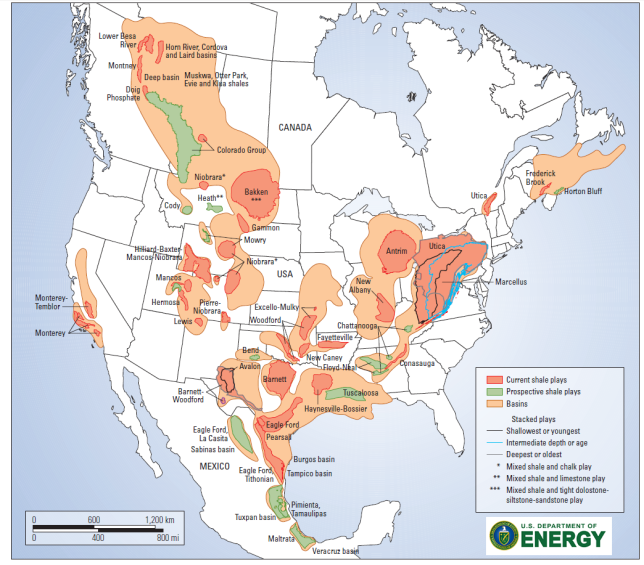

The most important change in the energy landscape has clearly been the shale boom with surprising production of natural gas and light tight oil using hydrofracking methods. The enormous new supplies of natural gas in the USA and Canada has altered long standing trade flows. Mexico wishes to get in on the act as well since they have large shale plays that have yet to be developed. North America has the potential to be an energy powerhouse and major exporter, but many regulatory details and infrastructure issues need to be sorted out.

For the Canadians, U.S. shale has created a new competitive environment. For decades Canada was a large exporter of natural gas to the USA via an extensive pipeline network. Now the exports are dropping, prices for Canadian gas have fallen and their own production has gone up as their own shale resources are developed. This challenging new environment for Canada has generated desire to build LNG export facilities, particularly on the Pacific coast of British Columbia that would serve Asian markets. Unfortunately, the proposed greenfield sites lie in environmentally sensitive areas that are for more expensive to build than competitive sites in the USA that are retrofits of existing import terminals. Against this backdrop lies the ongoing debate and tensions over approving the Keystone XL oil pipeline which remains unresolved and safety concerns over rail shipments of oil. So while production of oil and gas is booming in Canada, infrastructure and market issues remain that are keeping the industry occupied.

The story in Mexico is quite a bit different. The Mexicans are trying to ramp production up while also seeking increased imports of natural gas from the north. In December 2009 Mexico passed important constitutional reforms that would open up oil and gas development to foreigners for the first time in decades. Pemex, the national oil company has long held a monopoly on all oil and gas development in Mexico, but in the last decade production has been down and so has national GDP. At the same time new shale and deep water resources were discovered that cash starved Pemex had neither the capital nor the technical expertise to develop. USA and Canada are open, entrepreneurial markets allowing countless small companies to operate throughout the supply and development chain with their own niches of expertise. In Mexico, Pemex was the only player doing all the work, but the new reforms allow them to partner with foreign companies who bring capital and technical expertise even as Mexico continues to own all the resources. Details of these partnerships are still being sorted out and while there is optimism on both sides of the border the complexity of the legislative, regulatory and business arrangements is very high.

Mexico is also working to clean up their power sector that has long relied on fuel oil and diesel that is expensive and dirty. Electricity markets were opened up in 2013 to private interests for the first time and new natural gas power plants are being built. Gas imports via pipeline from the USA are increasing. Mexican national goals are to lower costs for electricity while improving reliability and emissions impacts.

America is seeing major investments in new chemical refineries and fertilizer plants using natural gas a feedstock. Pipeline flows are being altered as traditional south to north routes from the Gulf the Mexico feeding the northeast are being reversed to accommodate new supplies from Pennsylvania. LNG export terminals are being licensed and constructed and the U.S. expects to soon be a major natural gas exporter, a surprising turnaround from 2008 when imports were being readied.

Efforts to harmonize energy policies are built upon the foundation of NAFTA which created the world’s largest free trade zone in 1992. Critical issues that need to be addressed today include harmonization of environmental and emissions rules, particularly around greenhouse gasses but also criteria pollutants such as SOx and NOx. Reform of the Mexican power sector offers the opportunity to update their environmental regulations to catch up to standards in the USA and Canada. USA and Canada have different standards for railroad safety and it is increasingly important to align these rules as shipments of oil across the border increase along with heightened public scrutiny after recent accidents such as the one in Lac-Mégantic, Quebec. Infrastructure development of pipelines, refineries and export terminals should be coordinated to optimize markets for all, controversy over Keystone XL highlights some difficulties in this area. Though fuel standards for light duty and heavy duty vehicles are mostly homogenized there is still more work to be done, particularly in the area of alternative fuels. Climate change negotiations over greenhouse gas emissions globally also loom as an important area for coordination and negotiation.

There is enormous opportunity across North America to tap new energy resources, develop technology and upgrade infrastructure. With exports increasing the entire region is in a position to be in much greater control of its energy security and buffer itself from upheavals in other parts of the world. New natural gas supplies and upgrades to the power and transport sectors can help clean up pollution and lower greenhouse gas emissions. Jobs are being created and the energy sector has been one of the few economic bright spots since the 2008 recession. Regulatory and market coordination across USA, Canada and Mexico is generally moving forward in a positive direction to the benefit of all three countries but the issues are very complex and will keep policy makers busy for many years.