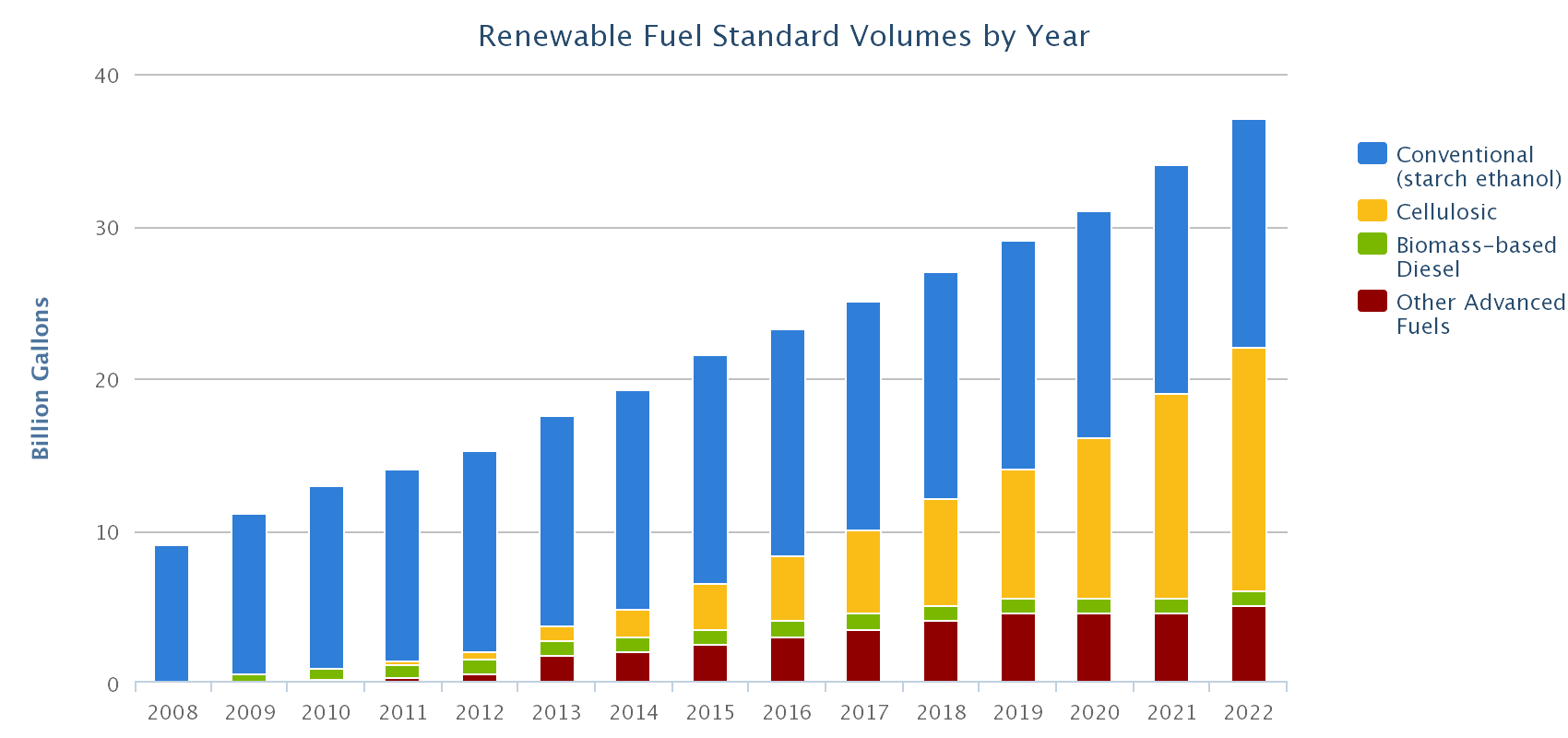

The EPA recently announced changes to the Renewable Fuels Standard (RFS2) that improves opportunities for biogas to be utilized as a vehicular fuel by qualifying it as an advanced cellulosic biofuel.

Biogas derived Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) produced from landfills, municipal waste-water treatment facility digesters, agricultural digesters, and separated MSW digesters all now qualify under the RFS. Additionally, electricity used to power electric vehicles produced from the same sources also qualifies as advanced cellulosic biofuel.

These pathways have the potential to provide notable volumes of cellulosic biofuel eligible for the RFS program and should be a factor in recent discussions to lower RFS fuel volume mandates. Significant volumes of advanced biofuels are already being generated from biogas, and in many cases this same fuel will now qualify for cellulosic RINs. As of 2014 the volumes of starch based (corn) ethanol RINs are capped under the RFS and expanding volumes of fuels are all prescribed to be cellulosic in origin, and can now be met with biomethane.

Credit: DOE, Alternative Fuels Data CenterUnder the RFS, the EPA uses RINs, Renewable Identification Numbers, to track renewable transportation fuels. Each RIN is attached to a physical gallon of renewable fuel as it is transferred to a fuel blender. After blending with fossil fuels RIN’s are used by obligated parties as proof that they sold renewable fuels and met their mandates. Obligated parties may buy and sell RINs to one another and RIN prices are determined by market factors similar to any other commodity.

When the RFS was first established the goal was to promote corn ethanol, biodiesel and cellulosic ethanol. Biogas was a minor component of advanced biofuels and did not receive a specific carve out of RINs, nor was biogas particularly well defined. Biogas was included in the RIN category of starch based fuels, meaning that it competed with sugarcane imported from Brazil for RINs. Under the new definitions, biogas is clearly defined as cellulosic, except for one category of food waste digesters which are still considered starch. Cellulosic advanced biofuel RINs are the most valuable category of RIN and under this category biogas competes with cellulosic ethanol.

The EPA has established very specific rules for determining biogas qualification for RINs. It is expected that the biogas is upgraded to pipeline quality Renewable Natural Gas, RNG (also known as biomethane) and injected into commodity natural gas pipelines. Raw biogas is around 65% methane and the remainder is mostly carbon dioxide, while pipeline natural gas is 95% methane. To earn RINs, producers must demonstrate their feed stocks and the physical connection from the biogas source to where it is upgraded and injected all the way to where the gas is extracted to produce CNG, LNG or electricity, contractual arrangements must also be demonstrated. The EPA determines on a case by case basis who along the process chain earns the RINs which provides market flexibility in the evolving business landscape.

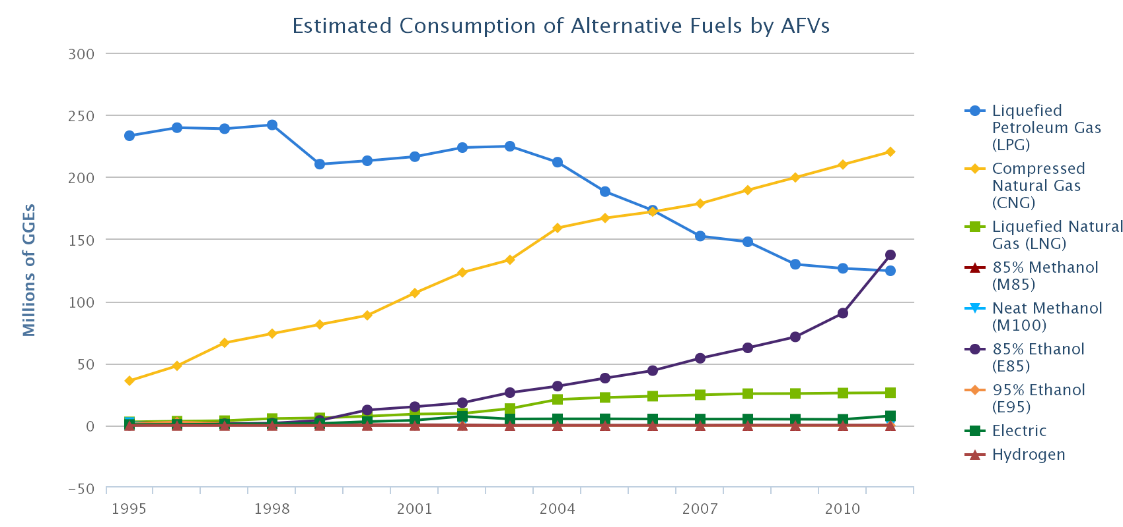

Defining biogas derived CNG, LNG and electricity as cellulosic biofuels is a market based adjustment by the EPA who has seen that cellulosic ethanol has been slow to meet production expectations while biomethane had exceeded expectations. Using RNG for a renewable transportation fuel offers large new market opportunities for biogas producers who have been challenged in competing with fossil natural gas in traditional gas markets. With the RINs, renewable CNG/LNG should compete with or even beat fossil CNG/LNG on price. Fossil CNG/LNG are already much lower cost than diesel at the moment.

RNG has big advantages as a renewable transportation fuel because it is chemically identical to fossil natural gas and is therefore a perfect “drop-in” fuel that requires no new technologies or vehicle modifications to CNG/LNG vehicles. Biogas production and upgrading to biomethane are well established technologies with zero technology risk.

Using RNG to provide electricity for electric vehicles (EV) is a novel concept for introduction to the RFS. Biogas has long been used to produce electricity on farms, and there are some examples of commercial firms purchasing RNG to produce electricity such as Apple at their data center in North Carolina that uses RNG in fuel cells. It is not clear however, that there are any commercial ventures in existence today that explicitly use RNG to power EVs. The EPA is clearly trying to promote this new potential market by providing incentives for EV charging infrastructure.

Credit: DOE, Alternative Fuels Data CenterThe overall resource potential for biogas is significant and underutilized. According to NREL in 2013, the methane potential from landfills, animal manure, wastewater and industrial, institutional and commercial organic waste in the USA is estimated to be about 7.9 million tons per year, equivalent to 420 billion cubic feet. This amount is equal to be about 5% of natural gas consumption for electric power or 56% of current natural gas consumption for transportation. Most of this methane is currently venting to the atmosphere as a potent greenhouse gas and not utilized.

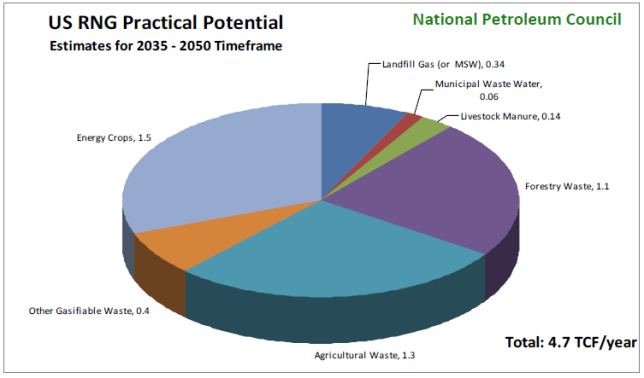

A more ambitious analysis of RNG potential was completed by the National Petroleum Council with other industry partners in 2012. While the NREL analysis only looks at sources of natural methane already in existence, the NPC analysis looks at the theoretical potential if all the energy crops, agricultural wastes, forestry wastes and other gasified wastes are included. The NPC arrives at an enormous 4.7 TCF (trillion cubic feet). This is not necessarily a practical estimate since there are competing uses for energy crops, agricultural and forestry wastes. Total natural gas consumption in the USA was a little over 26 TCF in 2013, so renewable natural gas could conceivably provide 18% of the total. The NPC estimated costs for RNG at a range from $5-$11 per MMBtu for common digester projects and up to a high of $25 per MMBtu for gasification projects with expensive feedstocks. Current natural gas prices hover around $4 per MMBtu, but are volatile.