This piece first appeared on the Energy Collective, Jan. 20, 2014.

The marine shipping industry is moving towards a heavy use of LNG, driven primarily by new emissions standards that come into place in 2015 combined with the low cost of natural gas from unconventional shale resources. Traditionally, big ships use bunker fuel, the heaviest and dirtiest of the petroleum fuels, but costs have risen in the past decade. These economics combined with environmental regulations and the growth in gas infrastructure have served as the tipping point which could see LNG establish itself as a viable primary fuel for commercial vessels in the US.

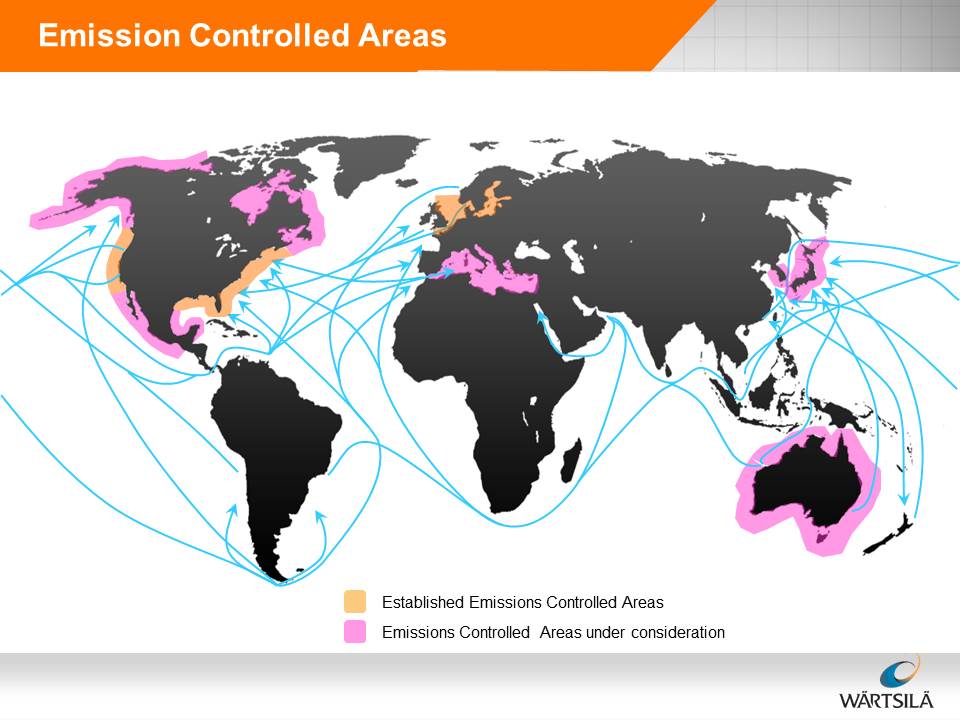

New maritime regulations include the North American Emission Control Area (ECA) requirements and Phase II of California’s Ocean Going Vessel (OGV) Clean Fuel Regulation. In 2015, seaborne traffic in North America, the US Caribbean, and European waters will be mandated to reduce fuel sulfur content from 1.0% to 0.1%.

In order to meet the emissions requirements ship owners must either use low-sulfur diesel which is not widely available and twice the cost of LNG or else install expensive exhaust scrubbers similar to those used on coal fired power plants. The third alternative, which has the lowest costs and the best performance is to convert to LNG fuel. Bunkering facilities for LNG need to be built to fuel the ships, but they are beginning to be built out now.

The global fleet of 42 LNG-powered ships will almost triple by 2014 and increase 42-fold to almost 1,800 vessels by 2020, according to DNV GL, the largest company certifying the merchant fleet for safety. Thirty-seven new LNG-fueled ships and two conversions are on order, scheduled for delivery in the next three years.

A little more than a decade after its first tests in the European market, North America companies have begun to penetrate the marine LNG fuel market with formidable speed. North America will at least have 31 LNG fueled vessels by 2018. Including “LNG-ready” vessels, this number rises to 42. More impressive however is that none of these vessels were in operation prior to 2013. The first LNG-fueled ship (that is not an LNG container ship) was a Norwegian ferry built in 2000. LNG container ships have for decades used the boil-off from their LNG cargo for fuel.

In the United States and Canada, Harvey Gulf International Marine plans to add new vessels to its fleet that already includes five LNG-fuelled vessels. Harvey Gulf is also building the first LNG bunkering facility in the U.S.

The biggest vessels ordered so far are two container ships for delivery in 2015 and 2016 for TOTE Inc., which runs services between the United States and Puerto Rico and Alaska. The design for the LNG-powered vessels won the Next Generation Ship Award in June at the industry’s biggest conference in Oslo.

Another ship owner, Matson has also decided to move forward with the construction of two new Aloha class 3600TEU containerships at Aker Philadelphia Shipyard. Designed for service between Hawaii and the West Coast, the 260.3 meter long vessels will be the largest containerships constructed in the US and feature dual fuel engines and hull forms optimized for energy efficient operations.

An LNG powered ferry set a new world speed record for ships in 2013 at 58.1 knots. The Francisco, an Argentine ship owned by Buquebus and built by Incat is powered by dual GE LM2500 turbines that produce 22 megawatts each (~30,000 horsepower). The innovative ship is an aluminum catamaran with a unique wave piercing design.

LNG powered ferry Francisco. World’s fastest ship at 58.1 knots.

FLNG & FSRU

Aside from the fuel transition, there are also new developments in off-shore gas production. Floating LNG (FLNG) production and Floating Storage and Regasification Units (FSRU) are an emerging sector of off-shore

infrastructure. Though currently limited in number, and not a factor in the USA, this revolutionary technology has the potential to greatly expand international markets for gas on both supply and demand sides by providing facilities on ships that can be relocated as needed to meet evolving market conditions and avoiding the risk of expensive stranded assets such as unused LNG import terminals in the USA.

FLNG has been pioneered by Royal Dutch Shell who recently floated the hull for its new vessel, the Prelude, which will be the largest ship ever built and the first FLNG project. This new technology offers the ability to develop stranded gas fields that are too far from shore to economically develop by traditional methods. FLNG vessels will be able to fill LNG container ships directly at the source of production. The Prelude will produce at least 5.3 million tons per annum (MTPA) of liquids, 3.6 MTPA of LNG, .4 MTPA of LPG and 1.3 MTPA of condensate. Malaysia’s state owned oil and gas company Petronas is working on its own FLNG vessel, PFLNG 1, which is expected to launch in Q4 2015 and will produce 1.2 MTPA of LNG.

FSRU vessels can be a vital link for new markets by enabling the cargo of an LNG carrier to be converted into its gaseous form on-board the vessel for direct delivery into shore-side gas pipelines. Prior to the advent of FSRUs, expensive (and permanent) shore-side storage and regasification facilities had to be built in order to import LNG. Since LNG markets can change quickly, having the ability to relocate expensive facilities to new locations as the market demands offers tremendous flexibility and allows new markets to be developed quickly. In January 2013, the floating regasification market reached 31.7 MTPA of import capacity spread across eight different countries.

Shell FLNG vessel Prelude. The world’s largest ship will produce natural gas from distant off-shore fields and liquefy it directly.

Shell FLNG vessel Prelude. The world’s largest ship will produce natural gas from distant off-shore fields and liquefy it directly.

Conclusion

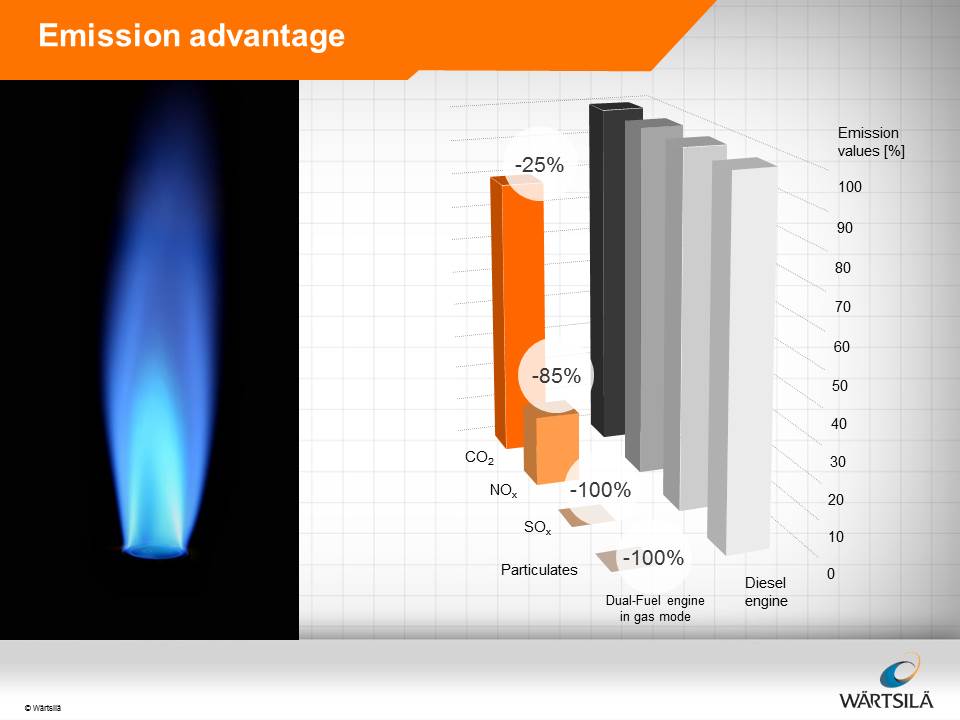

The fact that LNG has proven performance in cutting edge ship designs, favorable economics and decisive environmental advantages creates a compelling case for the maritime industry to commit to LNG. Just as diesel replaced steam locomotives in a rapid transition, it is possible to see a similar transformation happening in maritime shipping.